April 2024 Real Estate Statistics across Canada

Every month I look at these statistics with the intention of educating myself so I can help my clients to make better decisions. Unfortunately, these stats can only show me what already happened, based on solid data. There’s no crystal ball that can predict the near future. Please have a read and draw your own conclusions on what you think will happen in the next little while. I have summarized the main points from each region that I view as relevant. Full reports are also available under each city. Enjoy!

Victoria

“The spring market in Victoria kicked off with a gentle increase in sales when compared to last year and continued stable pricing,” said 2024 Victoria Real Estate Board Chair Laurie Lidstone. “These factors, combined with growth in the available inventory, has created a welcoming and more balanced market for buyers and sellers.”

There were 3,017 active listings for sale on the Victoria Real Estate Board Multiple Listing Service® at the end of April 2024, an increase of 14 per cent compared to the previous month of March and a 47.7 per cent increase from the 2,043 active listings for sale at the end of April 2023.

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in April 2023 was $1,295,800. The benchmark value for the same home in April 2024 decreased by 0.9 per cent to $1,284,600, up from March’s value of $1,279,300. The MLS® HPI benchmark value for a condominium in the Victoria Core area in April 2023 was $564,000 while the benchmark value for the same condominium in April 2024 increased by 0.7 per cent to $567,800, up from the March value of $567,300.

FULL REPORT HERE

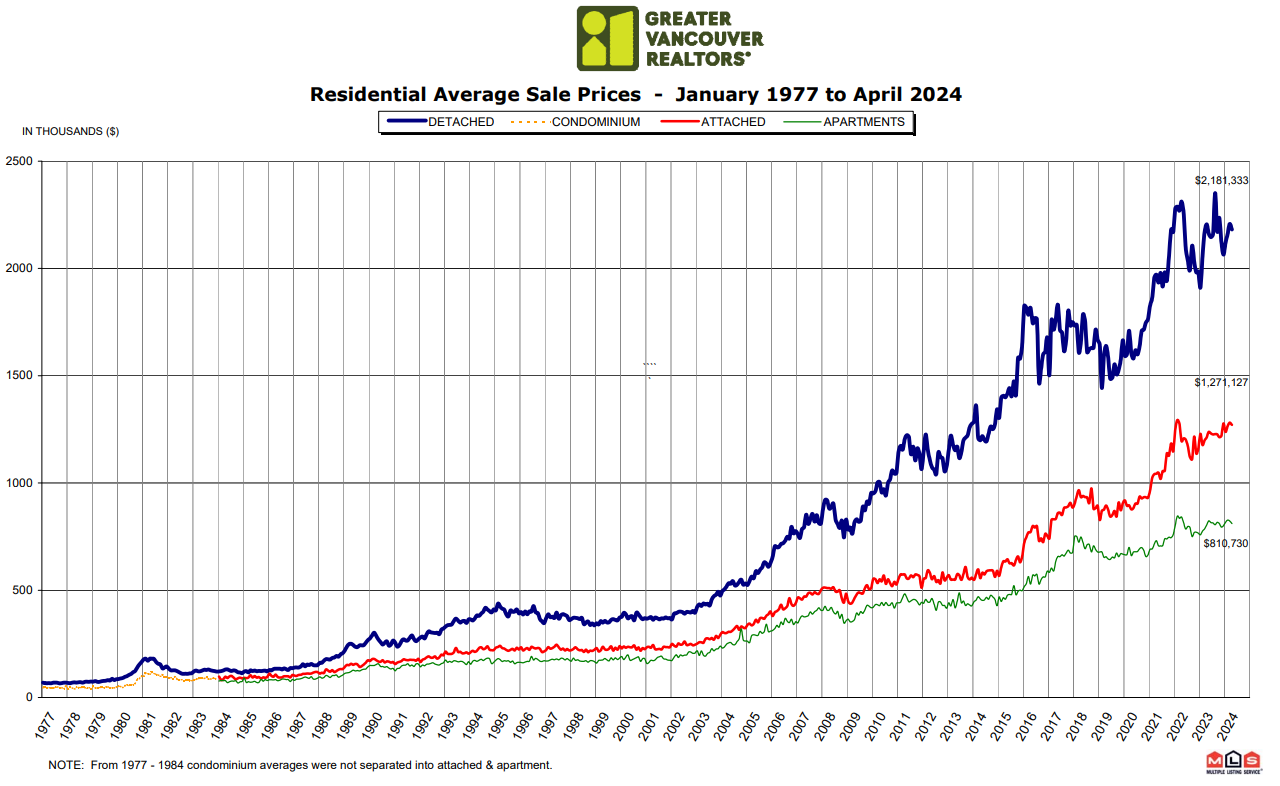

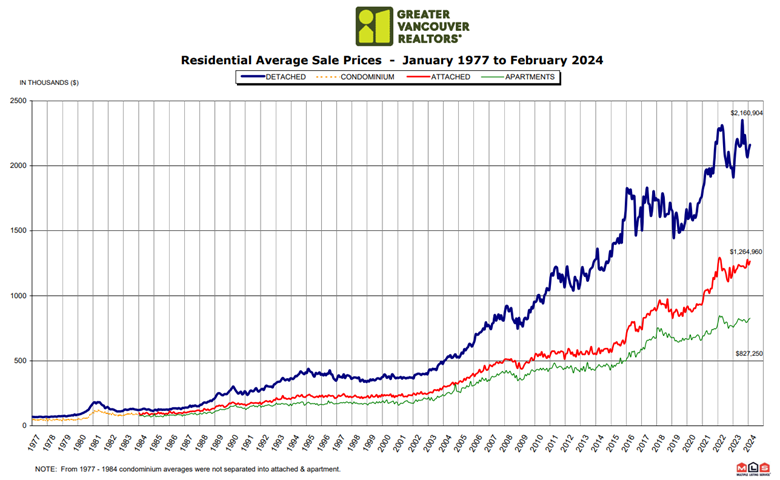

Vancouver

Inventory reaches highest level since the pandemic summer of 2020

Actively listed homes for sale on the MLS® in Metro Vancouver1 continued climbing in April, up 42 per cent year-over-year, breaching the 12,000 mark, a number not seen in the region since the summer of 2020.

There were 7,092 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in April 2024. This represents a 64.7 per cent increase compared to the 4,307 properties listed in April 2023. This was 25.8 per cent above the 10-year seasonal average (5,637).

“Another surprising story in the April data is the fact prices continue climbing across most segments with recent increases typically in the range of one to two per cent month-over month,” Lis said.

The benchmark price for a detached home is $2,040,000. This represents a 6.3 per cent increase from April 2023 and a 1.6 per cent increase compared to March 2024.

The benchmark price of an apartment home is $776,500. This represents a 3.2 per cent increase from April 2023 and a 0.1 per cent decrease compared to March 2024.

The benchmark price of a townhouses is $1,127,200. This represents a 4.3 per cent increase from April 2023 and a 1.3 per cent increase compared to March 2024.

FULL REPORT HERE

Calgary

Price growth persists in Calgary as seller's market prevails

“While supply levels are still declining, much of the decline has been driven by lower-priced homes," said Ann-Marie Lurie, Chief Economist at CREB®. “Homes priced below $500,000 have reported a 29 per cent decline. Meanwhile, we are seeing supply growth in homes priced above $700,000. Persistently high-interest rates are driving demand toward more affordable products in the market and, at the same time, driving listing growth for higher-priced properties.”

With a sales-to-new-listings ratio of 83 per cent and a months of supply of less than one month, conditions continue to favour the seller, driving further price gains in the market. In April, the unadjusted total residential benchmark price reached $603,700, a one per cent gain over last month and nearly 10 per cent higher than last year's levels. Price gains occurred across all property types and districts of the city. The strongest price growth occurred in the more affordable districts of the city.

Detached homes:

Adjustments in sales and inventory levels caused the months of supply to fall further this month. The less than one-month supply reflects a market favouring the seller, driving further price growth.

In April, the unadjusted benchmark price reached $749,000, over one per cent higher than last month and 13 per cent higher than April 2023 levels. Year-over-year gains were the highest in the city's most affordable districts.

Semi-Detached:

The persistently tight market conditions have caused further price gains. In April, the unadjusted benchmark price reached $668,400, nearly two per cent higher than last month and 13 per cent higher than levels reported last year. Year-over-year price gains ranged from a high of 23 per cent in the East district to a low of 10 per cent in the City Centre.

Row:

The persistently tight conditions, especially in the lower price ranges, are driving further price growth for row homes. In April, the unadjusted benchmark price reached $458,100, two per cent higher than last month and 20 per cent higher than levels reported last year. Both monthly and year-over-year gains were the highest in the most affordable districts of the North East and East, where resale row homes are still priced below $400,000.

Apartments:

Like other property types, year-over-year supply declines are driven by the lower-priced segments of the market, which for apartment condominiums is units priced below $300,000. Overall, persistent sellers’ market conditions in the lower price ranges are driving further price growth. In April, the unadjusted benchmark price reached $346,200 a month, a gain of over two per cent and nearly 18 per cent higher than last April. Year-over-year price growth ranged from over 30 per cent in the North East and East districts to a low of 13 per cent in the City Centre.

FULL REPORT HERE

Toronto

April 2024 home sales were down in comparison to April 2023, when there was a temporary resurgence in market activity. New listings were up strongly year-over-year, which meant there was increased choice for home buyers and little movement in the average selling price compared to last year.

“Listings were up markedly in April in comparison to last year and last month. Many homeowners are anticipating an increase in demand for ownership housing as we move through the spring. While sales are expected to pick up, many would-be home buyers are likely waiting for the Bank of Canada to actually begin cutting its policy rate before purchasing a home,” said TRREB President Jennifer Pearce.

The average price of a detached home in the area code (416) is $1,822,244. Semi-detached: $1,365,061. Townhouse $1,010,632. Condo:$766,917.

FULL REPORT HERE

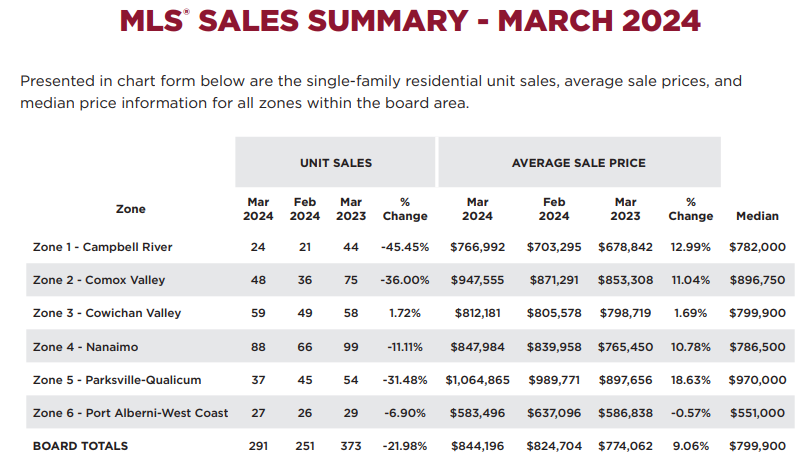

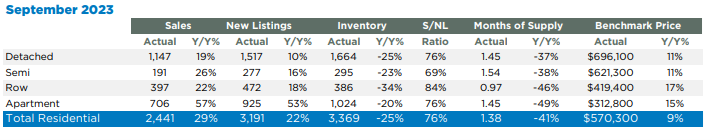

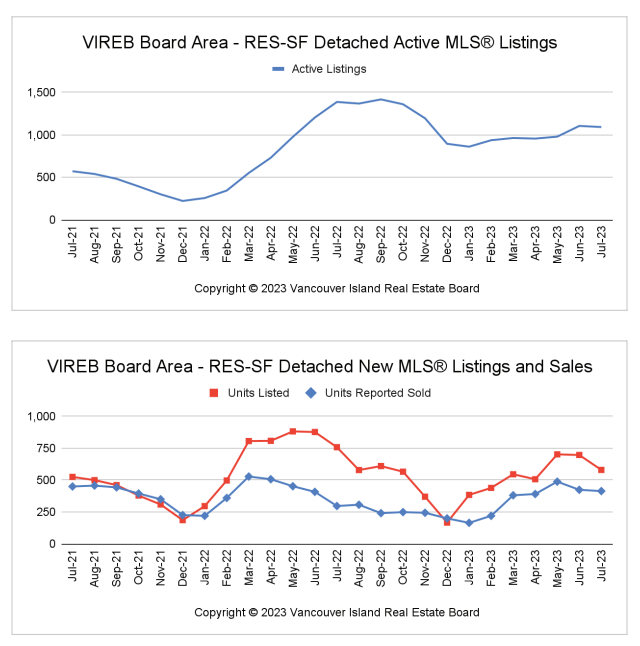

Nanaimo

“Sales are up from March, and REALTORS® are showing a lot of homes,” says Yochim. “Listings have also had a healthy boost, which is positive news, and sellers are responding to changing market conditions with price adjustments.” Yochim adds that Vancouver Island has experienced chronically low inventory for several years, so additional listings benefit buyers and sellers. “More inventory means more choices for buyers, but sellers also need somewhere to go when their home is purchased,” says Yochim. “Additional listings are a win-win for everyone.”

In Campbell River, the benchmark price of a single-family home was $678,800 last month, up seven per cent from the previous year. The Comox Valley’s year-over-year benchmark price rose by nine per cent to $857,300. In the Cowichan Valley, the benchmark price was $772,300, a four per cent increase from April 2023. Nanaimo’s year-over-year benchmark price rose by five per cent to reach $799,300, while the Parksville-Qualicum area saw its benchmark price increase by three per cent to $885,000. The cost of a benchmark single-family home in Port Alberni was $531,400, up four per cent from the previous year. For the North Island, the benchmark price of a single-family home dropped by two per cent to $413,300.

FULL REPORT HERE

Quadra Island Real Estate:

April was a busy month Quadra Island, with 5 new listings, 2 pending, 1 sold.

Current Listings on Quadra Island here

Cortes Island Real Estate:

in April Cortes saw 3 new listings, 1 pending, 1 expired.

Current Listings on Cortes Island here

In conclusion, I see that more inventory is already providing more options for buyers. It’s good for buyers and sellers alike because a lot of sellers will have to purchase a new property once they sell. Most people talk about housing as if it’s a commodity and to some extend it is, however it’s really a place where people live. When people can’t afford to live in their own house they will choose to sell and downgrade. Based on what i’m seeing in my day to day transactions a lot of people are selling because they need to downsize, move to a bigger city closer to hospitals. Most of my clients are watching the interest rates and hoping they will go back down. What will happen if they don’t? Are we on the verge of a buyers market? Are we going to be flooded with new listings and not enough interested buyers? What will happen to pricing if rates don’t go down? What will happen to pricing if the rates do go down? All these questions keep me up at night. Nobody truly knows but I feel like something needs to give. There’s too much tension in the market and we are way overdue for a correction.